In the modern rapidly evolving corporate world, companies are constantly searching for efficient ways to streamline their financial operations while maintaining security. One solution that stands out for Canadian enterprises is RBC Express Online Banking, a comprehensive solution that provides instant control, delegation features, and advanced protection.

As organizations grow and their financial processes become more complicated, it becomes essential to merge oversight with productivity. RBC Express addresses this challenge by allowing you to manage access across your team, track all activities, and securely manage your operations.

Exploring RBC Express Online Banking

RBC Express is a enterprise-level online banking solution from the Royal Bank of Canada (RBC). It is tailored for scaling organizations that require robust financial management tools.

It goes above and beyond the features of standard online banking by providing multi-user access, real-time insights, and multi-level authorizations.

The Power of Delegation

Delegating banking tasks is more than just reducing workload; it’s about building a structured operational environment. RBC Express allows for role-based access, supporting:

1. Role-Based Access Control (RBAC)

You can allocate each team member specific permissions. For instance, your HR manager can run salaries, while your accounting team can manage invoices, and executives can approve transactions.

2. Multi-Level Approvals

High-value transactions can be managed through approval hierarchies, ensuring no one person can authorize critical actions.

3.Real-Time Monitoring and Audit Trails

All user actions are tracked in real-time. If something goes wrong, you can investigate who did what and when.

4. Improved Productivity

By assigning roles, team members can focus on their core objectives, reducing wait times and improving efficiency.

Core RBC Express Features for Delegation

RBC Express includes several tools that make delegation seamless:

A. User Management Tools

You can create new users, edit roles, rbc express control access, and disable accounts when needed.

B. Permission-Based Services

Configure user access for:

- Recurring Charges

- Wire Transfers

- Payroll

- CRA Submissions

C. Custom Reporting and Dashboards

View and filter reports by:

- User Activity

- Branch/Department

- Financial Trends

D. Mobile Access with RBC Express App

The mobile version lets managers handle approvals, view balances, and receive alerts from anywhere.

Guaranteeing Security with Delegation

RBC Express is built with enterprise-level security protocols:

i. Two-Factor Authentication (copyright)

Users are required to verify identity using a mobile device for login.

ii. SSL Encryption

All data is secured with 256-bit SSL protocols.

iii. Session Timeouts

Automatic logout prevents unauthorized access in case of idle sessions.

iv. IP Restrictions

You can limit access based on IP or geographic region.

Begin Using RBC Express

1. Speak to your RBC Business Advisor

2. List roles and responsibilities

3. Create user profiles

4. Implement approval workflows

5. Inform your team

6. Regularly monitor activity logs and reports

Use Case Examples

1. Retail Chain

Regional managers handle local payments; finance department approves them; head office oversees.

2.Construction Company

Site managers initiate procurement payments; central finance approves transactions.

3. Non-Profit Organization

Program directors track expenses, while board members approve fund disbursement.

Final Thoughts: RBC Express is a Must-Have Solution

Forward-thinking companies need more than just access—they need control. RBC Express provides:

- Seamless task delegation

- Customizable permissions

- Layered approval processes

- Instant monitoring

- Best-in-class security protocols

If you're ready to take your business banking to the next level, explore the benefits at [https://customer-access.digital](https://customer-access.digital) and unlock how RBC Express can enhance your operations.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Alexa Vega Then & Now!

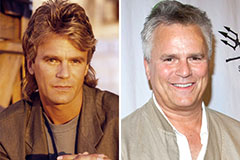

Alexa Vega Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!